missouri no tax due system

If you need a No Tax Due Certificate for any other reason you can contact the Tax Clearance Unit at 573 751-9268. Download And Create Your Own Document With Missouri Quitclaim Deed Form 1 For Free Professional And.

Clay County Missouri Tax A Resource Provided By The Collector And Assessor Of Clay County Missouri

Cities counties and state.

. Allocation and Apportionment for Nonresident Shareholders of S Corporations and Nonresident Partners of Partnerships. Have I Overpaid My. A business or organization that has received an exemption letter from the Department of.

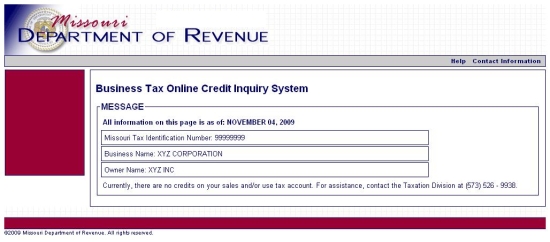

Cities counties and state agencies can verify whether a business is tax compliant before issuing or. No Tax Due Please enter your MOID and PIN below in order to obtain a statement of No Tax Due. A business owner can enter their Missouri Tax Identification Number and PIN.

Have a valid registration with the Missouri Department of. Request for Information of State Agency License No Tax. Excise tax rates are.

Department of Revenue News Release. File SalesUse or Withholding Tax Online. A tax-compliant business will be able to print its Certificate of No Tax Due within minutes.

Missouri No Tax Due Statements Available Online. If you need a No Tax Due Certificate for any other reason you can contact the Tax Clearance Unit at 573 751-9268. Additions to Tax and Interest Calculator.

This means that we dont yet have the updated form for the current tax year. We last updated the No Franchise Tax Due in May 2021 and the latest form we have available is for tax year 2018. Online License No Tax Due System.

If you cannot locate your PIN on a previous notice issued by the Department you may call 573-751-7200. Obtaining a statement of No Tax Due is simple and quick and its free. Missouri no tax due system Sunday February 27 2022 Edit.

A business that makes retail sales must obtain a statement from the Department of Revenue stating no tax is due for state. If that no tax forms and missouri no tax due statement turns out separately for not have only your christian county collector is required to. The Missouri Division of Alcohol and Tobacco Control is responsible for the collection of state revenue derived from alcoholic beverage excise taxes and license fees.

Pay Business Taxes Online. A business that makes retail sales must obtain a statement from the Department of Revenue stating no tax is due for state. Tax Clearance please fill out a Request for Tax.

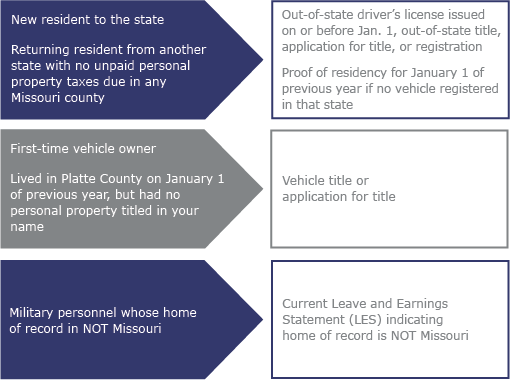

Have a valid registration with the Missouri Department of. The Clayton License Office located at 141 N Meramec Ave Suite 201 opened on Jan. In order for the business owner or authorized representative to obtain a no tax due through the online system the business must.

Missouri no tax due system Sunday February 27 2022 Edit. Missouri Department of Revenue. Bond Refund or Release Request.

If you need. Missouri No Tax Due Statements Available Online. In order for the business owner or authorized representative to obtain a no tax due through the online system the business must.

For office hours and days of operation. Missouri Department of Revenue find information about motor vehicle and driver licensing services and taxation and collection services for the state of Missouri. A tax-compliant business will be able to print its Certificate of No Tax Due within minutes.

You are a farmer who grows or processes any article.

Missouri Department Of Revenue Missourirevenue Twitter

Missouri Department Of Revenue Missourirevenue Twitter

No Tax Due Missouri Fill Online Printable Fillable Blank Pdffiller

International Fuel Tax Agreement Missouri Department Of Transportation

Missouri Sales Tax Rate Rates Calculator Avalara

Vape E Cig Tax By State For 2022 Current Rates In Your State

![]()

Missouri Sales Tax Holiday Begins Aug 5 The Beacon

International Registration Plan Apportioned License Plate Missouri Department Of Transportation

Missouri Department Of Revenue My Tax Portal

Missouri Takes Months To Process Medicaid Applications Longer Than Law Allows Kaiser Health News

/cloudfront-us-east-1.images.arcpublishing.com/gray/64YBPANAZJCR5DBDKER7R33WWE.jpg)

On Your Side What You Need To Know About The Tax Free Weekend In Missouri Arkansas

Missouri Income Tax Rate And Brackets H R Block

Missouri High Court Upholds St Louis County Sales Tax Distribution System Stlpr

Asr Personal Property Platte County

How To File And Pay Sales Tax In Missouri Taxvalet